From Hype to Hardware: If You're in Populist VC, Pivot to Wartime VC.

Build for War or Lose it to Eminent Domain. Venture Capital Must Shift Toward a Wartime Economy.

Venture has a choice. Build the industrial backbone for deterrence and rapid mobilization today, or accept emergency powers tomorrow that deliver slower timelines and lower compensation while our adversaries sprint.

We are standing at a crossroads. The path we choose now will determine whether America enters a large-scale war—whether with a peer competitor like China or in a broader global conflagration—prepared and capable, or by force of circumstance scrambling under emergency powers, eminent domain orders, and production backlogs. Venture capitalists, engineers, founders, technologists, and investors have more agency than they acknowledge. There is a patriotic duty in steering capital toward deep tech and defense manufacturing today, before necessity forces the state to seize property, commandeer factories, and impose measures that dole out lower compensation and slow every timetable.

For too long, hype-VC has chased fast profits. Startups build apps, platforms, “social” hooks, and growth curves meant to scale quickly, exit quickly, and return capital fast. That model suits many sectors, but it is misaligned with what the country actually needs in a fragile global order. A 2020 working paper from the National Bureau of Economic Research (Lerner, Nanda, et al.) shows venture capital tends to cluster in narrow areas of high growth, where exits are visible, rather than in capital-intensive, long lead-time domains such as infrastructure, defense, or basic materials.¹ When the VC model emphasizes rapid exits over long-term societal value, we risk underinvestment in technologies and manufacturing capabilities critical for national security.

Hype-Fueled Misallocation

This distortion is visible in hype-driven flows into crypto and AI, where capital surged not because of long-term industrial necessity but because of short-term speculative frenzy. Venture capital has poured billions into sectors like crypto and AI, tracking not national needs but the frequency of Google searches and hype-cycle headlines. The result is a mirror of public attention rather than strategic allocation.

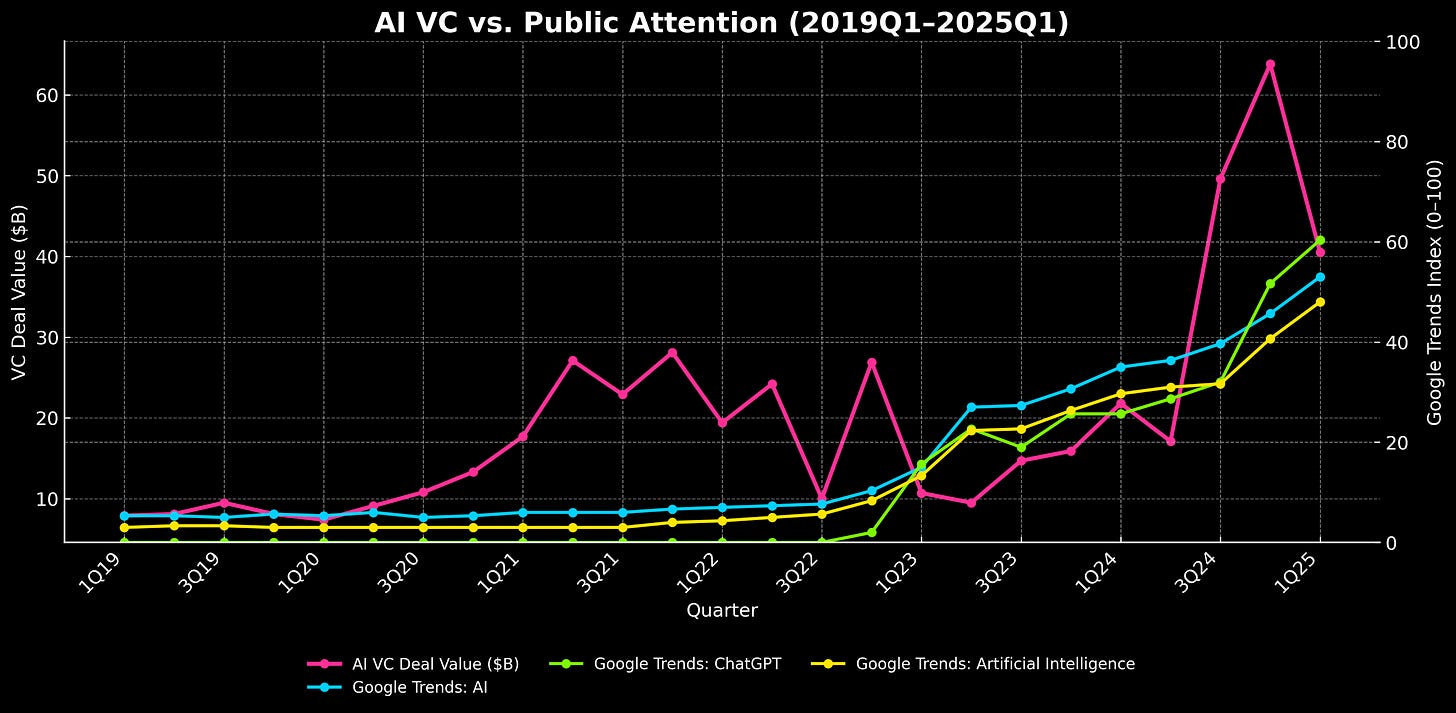

Figure 1. VC Deal Value in AI vs. Google Search Frequency for AI Buzzwords

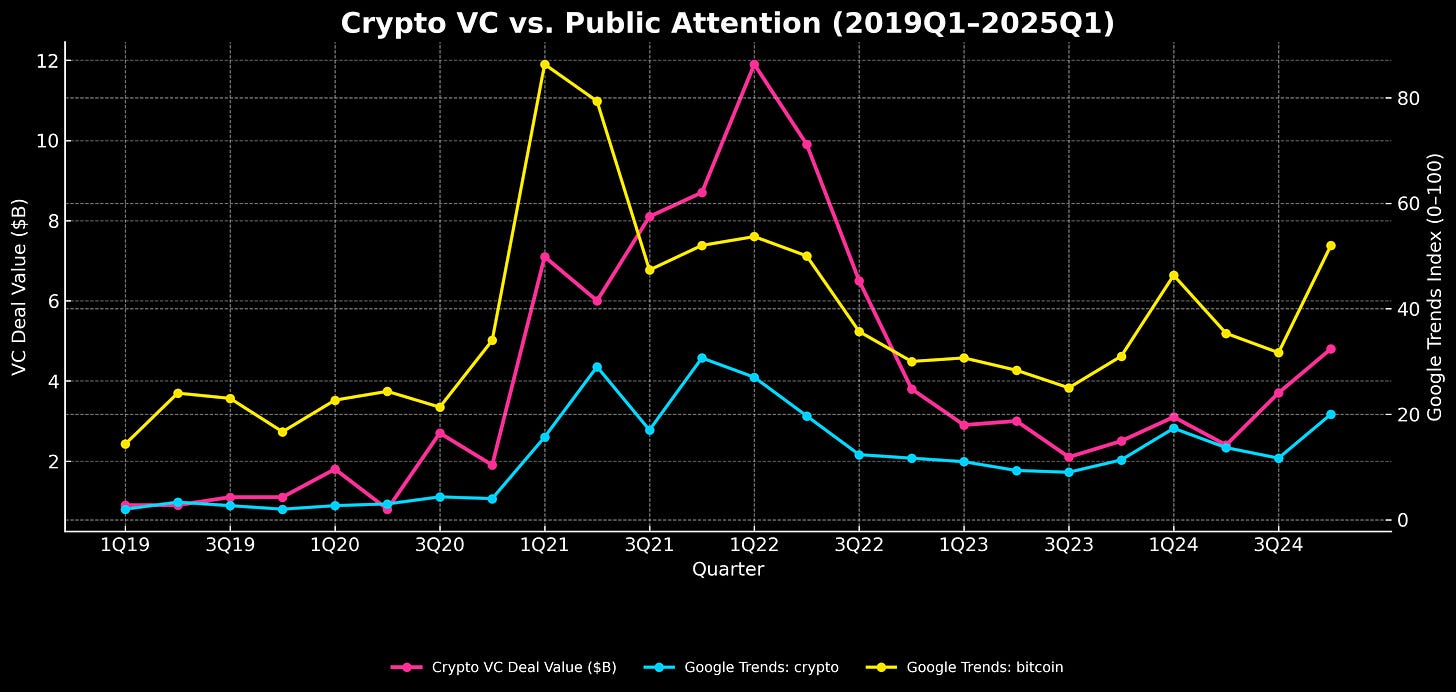

Figure 2. VC Deal Value in Crypto vs. Google Search Frequency for Crypto Buzzwords

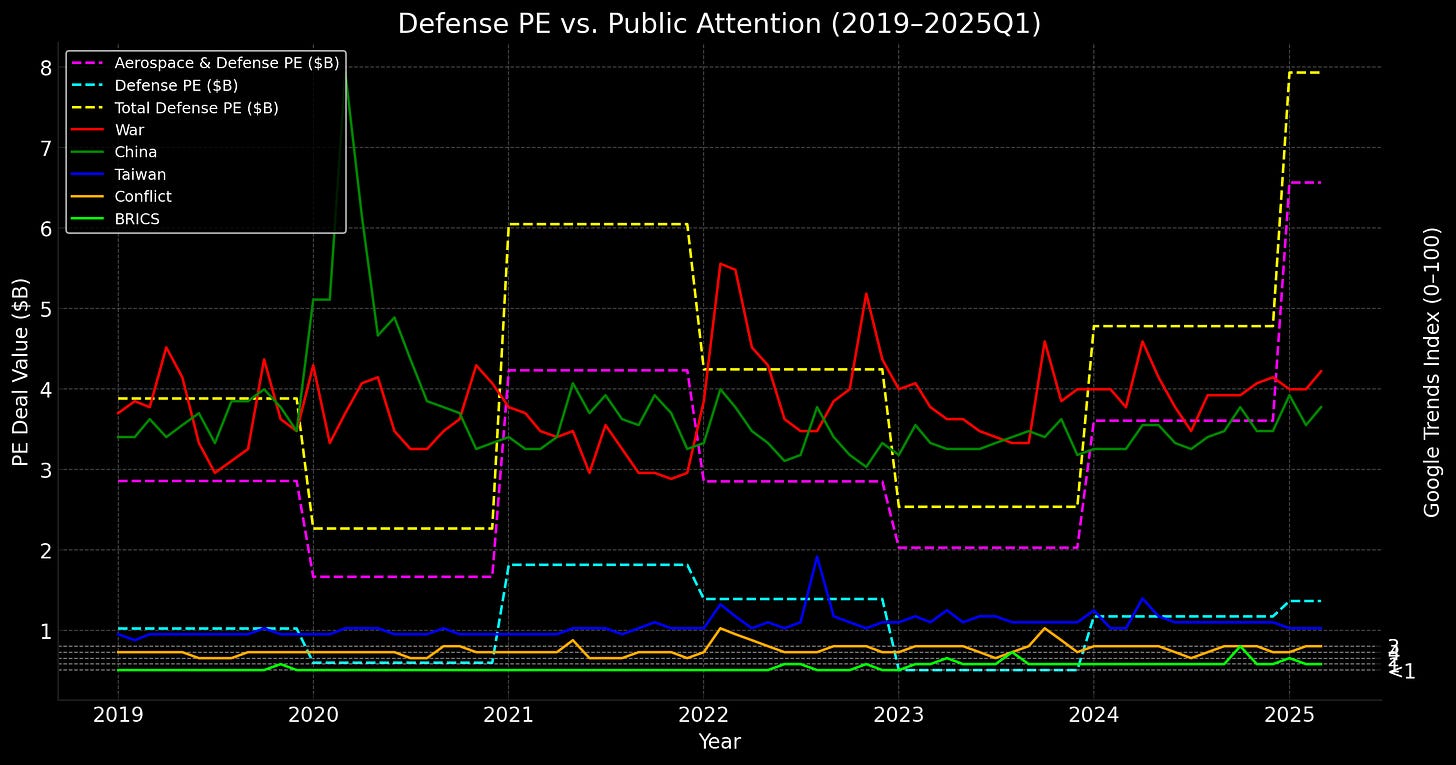

Figure 3. Defense-Related Private Equity Deal Value vs Google Search Frequency for US Defense-Related Keywords

The patterns across these three figures reveal the pathology of hype investing in stark relief.

In crypto, VC deal value surged in near-perfect lockstep with Google search activity for “crypto” and “bitcoin.” Peaks in public curiosity (2021–2022) coincide almost exactly with the crest of venture dollars, and the decline after 2022 mirrors the collapse in attention. This is not strategic allocation — it’s reflexive speculation, with capital chasing noise rather than necessity. Billions poured into ephemeral tokens and platforms that evaporated as quickly as they rose.

In AI, the frenzy has unfolded even more dramatically. Venture flows into AI rose gradually through 2021 but then exploded after ChatGPT’s release in late 2022. Search activity for “AI,” “Artificial Intelligence,” and “ChatGPT” each chart an almost perfect overlay with deal volumes. This is a textbook hype-cycle: attention translates into dollars, valuations balloon, and investors justify their bets not by fundamentals but by the sheer ubiquity of the conversation. While some of these investments will generate enduring value, the statistical correlation with Google search data shows the engine is speculation, not sober industrial planning.

By contrast, defense PE tells a different story. Deal values in aerospace & defense have remained relatively steady, even as public search interest around “war,” “China,” “Taiwan,” and “conflict” has spiked in waves tied to geopolitical events (Ukraine 2022, Taiwan tensions 2023, BRICS expansion talk 2023–2024). Capital here is thin, flat, and reactive — it has not surged to meet strategic demand. Where hype sectors see dollars flood in as attention climbs, the very domains critical to deterrence and national security have been comparatively starved. Investors are not following the risk landscape — they’re ignoring it, leaving preparedness to lag behind geopolitical realities.

Taken together, these figures show a structural misallocation: venture is highly elastic to hype but inelastic to necessity. Dollars chase Google searches in crypto and AI but barely register in defense, even as the strategic temperature rises. Statistically, this reflects venture’s short horizon bias: strong positive correlation with public attention indices (ρ > 0.7 in AI and crypto) but near-zero elasticity when it comes to defense, where capital should be leading, not lagging.

This is the pathology of hype-investing: capital is gravity-bound to headlines, not history. And when crisis comes, the correction will not be voluntary—it will be coercive. The state will seize what venture neglected to build. That’s the cost of letting hype dictate allocation.

In other words, hype pulls capital into shallow waters while critical technologies—munitions, advanced materials, logistics, energy systems—remain starved. Without intervention, this cycle repeats until crisis makes reallocation involuntary.